Ahmedabad: The fall intake frenzy and the unrelenting lure for overseas education, coupled with the rising cost of living abroad, sparked a surge in education loan disbursals.

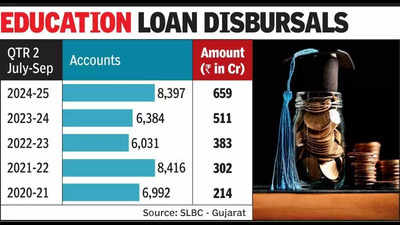

According to the latest report by the State Level Bankers’ Committee (SLBC), Gujarat, education loan disbursals in the state increased by 29% in the second quarter (Q2) of FY25, reaching Rs 659 crore compared to Rs 511 crore in the same period last year.

Meanwhile, the number of loan applicants jumped by 32%, rising from 6,384 to 8,397 during the same period. The surge is seen despite the recent decline in foreign education aspirants to Canada due to changes in its immigration policies.

Bankers and foreign education experts attribute this growth to a combination of factors, including the rising cost of living abroad, fluctuating currency value, and an increasing number of students opting for higher education overseas.

“The demand for education loans at our bank has grown by more than 100% since 2022, with 95% of applications coming from foreign education aspirants. For students with exceptional academic performance and records who secured admission in certain specific universities of repute, collateral-free and unsecured loan products are also available,” said a private banking professional, requesting anonymity.

This is especially true for the US, where students with good scores and profiles tend to get unsecured education loans up to as high as Rs 75 lakh.

“The depreciation of the Indian rupee against the US dollar, Euro, and British pound pushed up student expenses while surging rental costs in major global cities further inflated budgets. This led to a significant increase in the ticket size of education loans, directly impacting the overall disbursals,” the professional further added.

Over three years, i.e., from FY22 to FY25, the education loan disbursals grew 118% during the second quarter, clearly reflecting the increased cost of living and fees besides the rising number of applicants. Bankers also pointed to a growing awareness of better opportunities abroad as a key factor driving this trend.

“Banks are also offering student-friendly schemes, including collateral-free loans and competitive interest rates, to make higher education abroad more accessible. Banks often identify top-tier universities, and if students gain admission to these institutions, loan approvals are much simpler,” said a senior SLBC Gujarat official, requesting anonymity.

The US continues to dominate as the top destination for Gujarat’s students, but other countries like the UK, Germany, Australia, France, and the Netherlands are also gaining traction. Canada, however, has seen a sharp drop in applicants due to recent policy changes, prompting students to pivot to alternative destinations.

“Studying abroad is no longer limited to postgraduate degrees. Over the past 4-5 years, there has been a significant rise in students going overseas right after school, particularly for undergraduate programmes. This shift led to a noticeable jump in overall numbers,” said Ahmedabad-based foreign education consultant Bhavin Thaker.

Box: Edu Loan Disbursals

QTR 2 (July-Sep) Accounts Amount (Rs cr)

FY25 8,397 659

FY24 6,384 511

FY23 6,031 383

FY22 8,416 302

FY21 6,992 214

Source: SLBC – Gujarat

[ad_1]

Source link