MUMBAI: The Patels and Shahs in Gujarat’s Botad, and Bordolios and Baruas in Assam’s Barbaka may not have much in common. Chances that these Indians have any link with Donald Trump or Paul Atkins are even weaker. One thing, however, is emerging that could link all these people across the globe: Their love for cryptocurrencies.

Smaller cities and towns in India are becoming active hubs of crypto trading, joining the bigger metros where people have been trading these digital assets for several years now. There’s a growing appeal for cryptos among people – mostly 35 years old or younger – from places like Botad, Barbaka, Jalandhar, Kanchipuram, Patna and several other smaller Indian cities and towns, a report by CoinSwitch showed.

“What was once concentrated in major metros is now quickly expanding to tier-two and tier-three cities, reflecting the growing appeal,” said Balaji Srihari, VP, CoinSwitch. In India, which has more than two crore crypto users with the bulk of them under 35 years, the ecosystem is also evolving with investors diversifying their asset portfolio and taking their picks in meme coins to Layer-1 (assets like Bitcoin and Ethereum) and DeFi tokens.

Local investors are increasingly taking to meme coins which make up for about 13% of all crypto investments in the country. Within the category, Dogecoin topped the list of the most invested coins while SHIB led the way for the most traded coins.

The rush among Indians to invest in cryptocurrencies comes despite the imposition of steep taxes on crypto transactions – currently income from cryptocurrency transactions is taxed at 30% while a 1% TDS is levied on transactions exceeding Rs 50,000 annually. There are also deliberations within govt to regulate the crypto space.

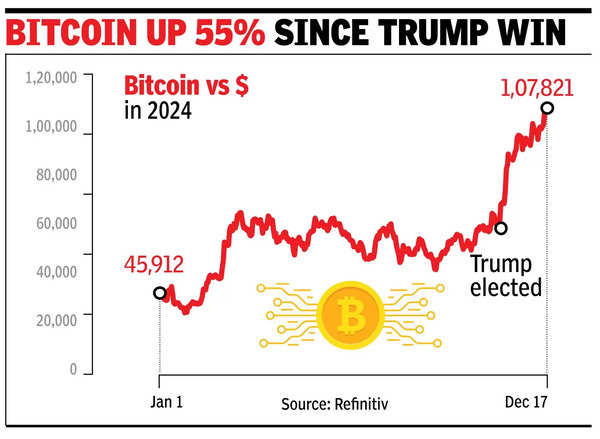

Recently, crypto lovers around the world got a boost after Donald Trump, a recently-turned crypto supporter, was elected the US President. And soon enough he nominated Paul Aktins, a lawyer and a long-time crypto supporter, to lead financial markets regulator SEC.

These developments led to a nearly unabated rally in cryptos since the US election day. And in 2024 so far, Bitcoin has given a 144% return and a market cap of $2 trillion. This makes it larger than silver and about a tenth of gold in terms of market capitalisation, said Ashish Singhal, co-founder, CoinSwitch. “Trump’s unequivocal support for Bitcoin and his pro-crypto stance has been a major positive development for the crypto sector,” Singhal said.