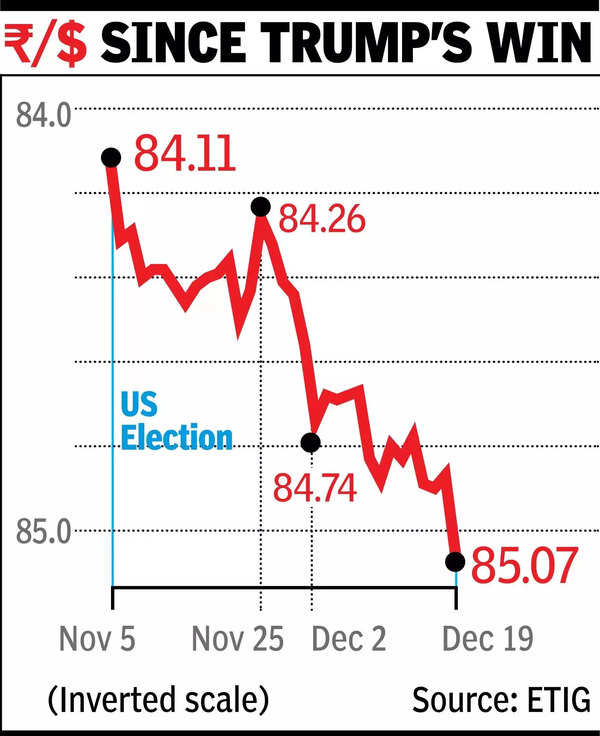

MUMBAI: The rupee breached the 85 level for the first time on Thursday as the dollar gained ground across most currencies in the wake of the US Federal Reserve indicating that there would be fewer rate cuts in future than expected.

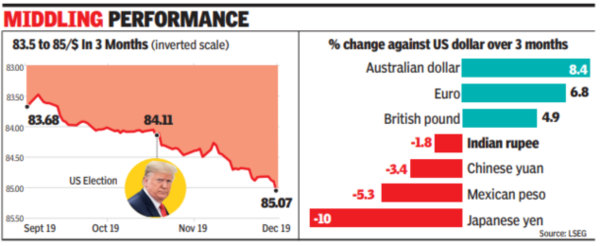

In percentage terms, rupee decline was marginal, dipping from 84.95 on Wednesday. However, with the dollar gaining against most currencies, there was concern RBI may let the currency slide. “Forex reserves are down from peak levels of over $ 700bn at around $ 655bn. Liquidity is also tight for a different set of reasons,” said Madan Sabnavis, Bank of Baroda chief economist.

Rupee’s fall has not made Indian exports more competitive: Report

Madan Sabnavis, chief economist of the Bank of Baroda, said, “More likely these currency movements will be compared across other currencies too in order to gauge how the rupee is positioned. But for sure, there will be volatility for some more time, and it may not be a sober Christmas for the markets.”

According to Reuters data, the rupee’s drop to 85 from 84 has taken place in about two months, while the decline to 84 from 83 took nearly 14 months. It took the currency 10 months to decline to 83 from 82. The rupee decline was less compared to fall in the value of the Korean won, the Malaysian ringgit, and the Indonesian rupiah — which were down 0.8%-1.2% on the day. The rupee closed at 85.07 on Thursday. The rate cut by the US Fed roiled markets with most Asian currencies sliding against the dollar.

A weaker rupee makes imports more expensive and pushes up headline inflation, but it also makes exports more competitive and helps manage the trade deficit. For individuals, it benefits non-resident Indians who sent $129 billion home this year, but it is a disadvantage for Indians who spent nearly $31 billion on travel, education and investments overseas. Currency dealers noted that the rupee’s movement is not significant enough to impact foreign travel decisions but may slightly curb spending.

According to the treasury head of a private bank while the rupee has crossed a psychological threshold by breaching 85, looking at forward rates from a year ago, the rupee is exactly where it was expected to be. The currency is likely to remain rangebound.

Trump taking office is the next key event, but the extent to which his proposed policies will be implemented remains uncertain, as many of them are counterintuitive. Tariffs could exert upward pressure on inflation, and while a stronger dollar may reduce headline inflation, it will not significantly enhance US competitiveness since Chinese imports would become more attractive. Crisil in a report following the trade deficit notes that the Indian rupee’s value against other currencies has dropped (nominal depreciation), but this hasn’t made Indian goods more competitive in the global market. This is because even though the rupee appears weaker, its “real” value, which accounts for inflation and trade competitiveness, has actually increased.