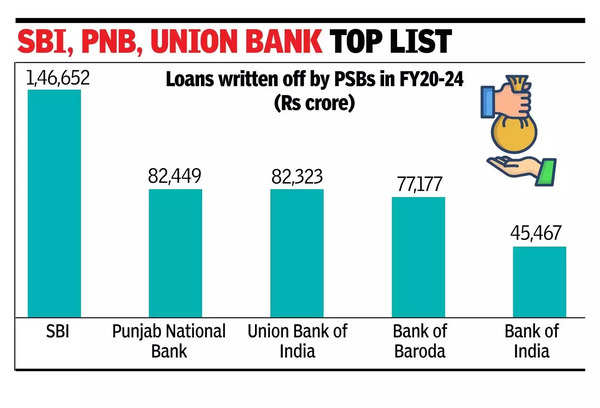

MUMBAI: Loans written off by commercial banks between FY15 and FY24 totalled Rs 12.3 lakh crore. Of this, 53% or Rs 6.5 lakh crore of the write-offs were by public sector banks in the last five years (FY20-24), according to data provided by the government in response to Parliament queries.

The loan write-offs by the banking sector peaked in FY19 at Rs 2.4 lakh crore, which followed an asset quality review that began in 2015. It fell to the lowest level of Rs 1.7 lakh crore in FY24 which was only 1% of total bank credit of around Rs 165 lakh crore outstanding at that time. Public sector banks currently have a share of 51% of the banking sector’s incremental credit, lower than 54% in FY23.

Read also: Gross NPAs of PSU banks drop to 3.1% from 14.6% in ’18

Pankaj Chaudhary, minister of state for finance, said that according to RBI data, gross NPAs of public sector banks and private sector banks as of September 30, 2024 were Rs 3,16,331 crore and Rs 1,34,339 crore, respectively. Further, gross NPAs as a percentage of outstanding loans was 3.01% in public sector banks and 1.86% in private sector banks.

SBI, which accounts for around a fifth of banking activity, wrote off Rs 2 lakh crore during the period. Punjab National Bank wrote off Rs 94,702 crore worth of loans among nationalised banks. During the current fiscal up to end-September PSU banks have written off Rs 42,000 crore of loans as against Rs 6.5 lakh crore for the preceding five years.

Read also:

Responding to the query on PSB write-offs, Chaudhary said: “Banks write-off NPAs in respect of which full provisioning has been made on completion of four years, according to RBI guidelines and policy approved by banks’ boards. Such write-off does not result in waiver of liabilities of borrowers and therefore, it does not benefit the borrower and banks continue to pursue recovery actions initiated in these accounts.

He added that the recovery methods include filing of a suit in civil courts or in debt recovery tribunals, action under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, filing of cases in the National Company Law Tribunal under the Insolvency and Bankruptcy Code, 2016, through negotiated settlement/ compromise, and through sale of NPAs.

Goverment, in a separate statement, said that public sector banks in India recorded their highest-ever aggregate net profit of Rs 1.41 lakh crore in FY24. This was supported by an improvement in asset quality, with the gross NPAs ratio declining to 3.12% in Sept 2024. In the first half of 2024-25, PSBs reported a net profit of Rs 85,520 crore.