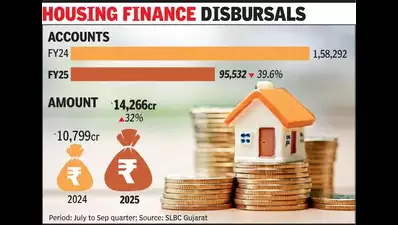

Ahmedabad: The housing finance market in Gujarat is facing a paradox — fewer people are borrowing, but those who do, are borrowing big. According to the latest State Level Bankers’ Committee (SLBC) report, the number of housing loan takers saw a sharp decline of 39.6%, dropping from 1.58 lakh accounts in the Sep quarter of FY 2024 to just 95,532 accounts in the same period of FY 2025.

Despite the steep fall in loan accounts, the overall disbursal amount shot up by 32%, driven by a remarkable 118% jump in loan ticket sizes — from Rs 6.82 lakh to Rs 14.93 lakh per account. This trend clearly signals that while demand for affordable housing has taken a backseat, high-value properties continue to claim the spotlight. While higher-value properties shine, the absence of affordable buyers hints at an uneven economic scenario. The takers for home loans declined for the second consecutive quarter in Gujarat. According to the SLBC report, some 1.01 lakh people opted for home loans in the June quarter of FY 2025 compared to 1.5 lakh borrowers in the corresponding quarter of FY 2024.

“The decline in the number of housing loan takers reflects the shift in market dynamics because currently, the demand in the housing sector is low. This is particularly true for the affordable residential segment,” said an SLBC official requesting anonymity.

For the real estate sector, this signals a significant tilt towards premium and luxury housing. This trend could have broader economic implications.

With the jantri rate revision announced in April 2023, property prices soared, and this impacted the demand in the residential real estate market gravely, according to industry players.