Ahmedabad: The income tax (I-T) department has begun issuing notices to MNC employees holding foreign-based Employee Stock Options (ESOP) who haven’t declared dividend income from these shares. Experts said this was the first time several people were issued notices for not disclosing their foreign income and assets in their previous return, including property, shares, and dividends.

A case involves a Gujarat resident employed at a Bengaluru IT firm who possesses ESOPs from their American parent company. Experts said tax authorities are now obtaining ownership details of foreign assets from countries including the USA and UAE.

Jainik Vakil, who chairs the direct tax committee of the Gujarat Chamber of Commerce and Industry (GCCI) and works as a chartered accountant, said, “For the first time, the income tax department has started issuing notices in large numbers to resident Indians for not disclosing their foreign assets. If they don’t file revised returns declaring their ESOPs before Dec 31, taxpayers may face penalties.”

The official notice reads, “As part of ongoing collaborative efforts to ensure compliance with tax regulations, we have received information concerning foreign assets and income from the USA, such as bank accounts, interest, dividends, etc., that may be associated with you … Any non-disclosure of foreign income or assets may cause initiation of proceedings for assessment, imposition of penalties, and/or prosecution under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.”

The I-T department urged the taxpayers to revise their income tax return (ITR) to ensure it reflects all relevant information, including any foreign assets or income.

Tax professionals indicated that individuals must declare foreign depository accounts, custodial accounts, foreign equity and debt interests, insurance contracts, financial interests, immovable property, capital assets, and signing authority details for accounts in any foreign country. Additionally, information about overseas trusts where the individual serves as trustee, beneficiary, or settler must be disclosed too.

Vakil explained, “If a taxpayer fails to disclose foreign assets or income in the ITR, proceedings for assessment may be initiated. If the non-disclosure results in underreporting of income, a penalty equal to 200% of the tax evaded may be levied. Non-disclosure of foreign assets and income in income tax returns can lead to a penalty of Rs 10 lakhs.”

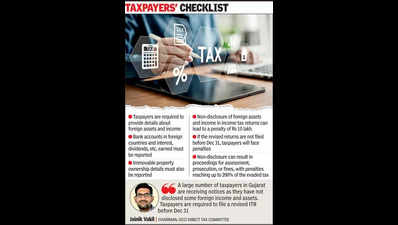

Head: Taxpayers’ checklist

– Taxpayers are required to provide details about foreign assets and income

– Bank accounts in foreign countries and interest, dividends, etc., earned must be reported

– Immovable property ownership details must also be reported

– Non-disclosure of foreign assets and income in income tax returns can lead to a penalty of Rs 10 lakhs.

Photo Quote:

A large number of taxpayers in Gujarat are receiving notices as they have not disclosed some foreign income and assets. Taxpayers are required to file a revised ITR before Dec 31.

– Jainik Vakil | Chairman, Direct Tax Committee, GCCI